THANK YOU to everyone who came out and voted on March 11th. Keep the momentum going into the FY27 budget season.

Blog

- Historical Financial Data

- Your chance to be heard!

- School Board Meeting 10/3

The three Citizen’s Petitions below were submitted to the School Board to appear on the ballot in March as Warrant Articles. Vote YES on all three.

- Lease Purchase Agreement: Shall the Timberlane Regional School District (TRSD) vote to rescind and terminate the March 14, 2023 adoption of Article-3 Lease Purchase Agreement of $25,243,000 as authorized by TRSD.

- Fund Balance Retention: Shall the Timberlane Regional School District (TRSD) vote to rescind the March 14, 2023 adoption of Article-15 Fund Balance Retention of 5% as authorized by TRSD.

- 2.5% Tax Cap on Operating Budget: Shall the Timberlane Regional School District (TRSD) vote to adopt the provisions of RSA 32:5-b, and implement a tax cap whereby the governing body and budget committee shall not submit a recommended budget that increases the amount to be raised by local taxes, based on the prior fiscal year’s actual amount of local taxes raised, by more than 2.5%.

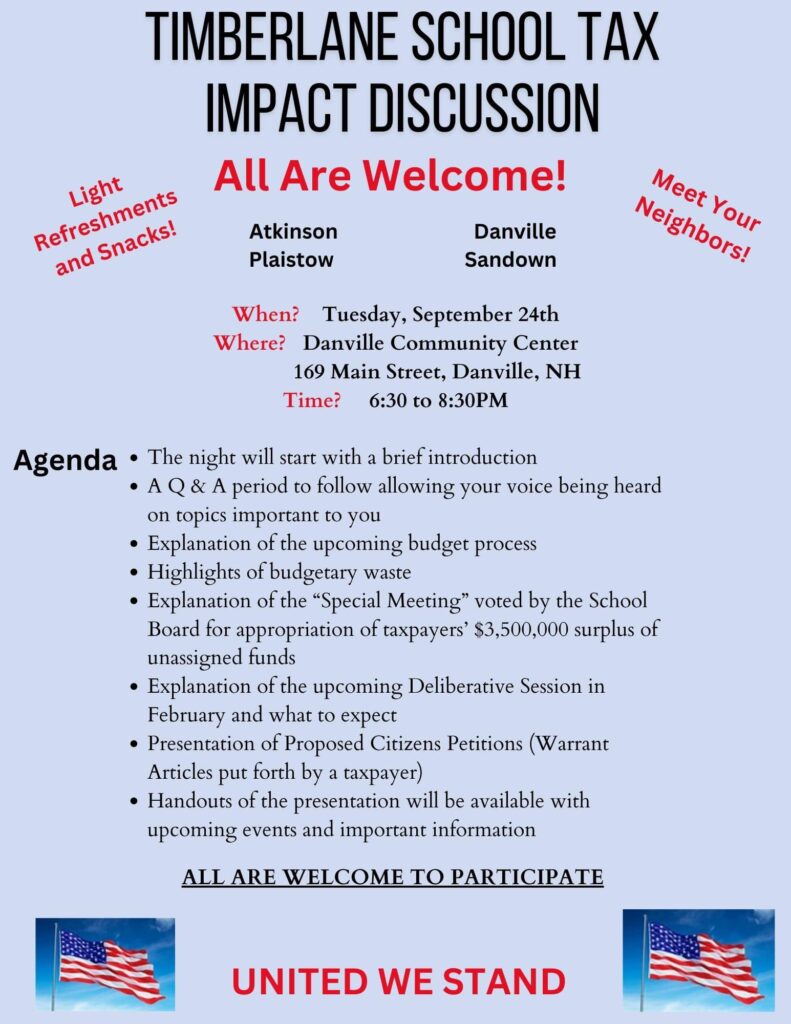

- 9/24 Meeting@Danville CC

- Continued fiscal irresponsibility

After pledging to return the entirety of the $16.4 million 23-24 budget surplus, the school board has instead voted to retain $3.5 million. They intend to conduct a special meeting where the public can vote on whether or not to use the $3.5 million to make a payment towards the EEI lease for projects being completed around the district. They say that making the lease payment will save $1.4 million in interest. There are two problems with this.

- The $3.5 million withheld from the 23-24 surplus is not needed to make this lease payment. The 24-25 budget includes $2.1 million to be used towards a lease payment and the district received an additional $1 million from the state in adequacy aid. The $3.5 million in surplus from 23-24 could have been returned to the taxpayers and the lease payment could have been made (still saving the $1.4 million in interest) using money from the current 24-25 budget.

- Even if, at the special meeting that has yet to be scheduled or announced, the public votes against using the $3.5 million withheld from the 23-24 surplus, it’s too late for this money to be returned to the taxpayers. It will have to carry over to the 24-25 budget, presumably contributing to another massive budget surplus next year (unless the school board does everything in their power to spend it down).

Below is a PDF copy of the statement made by John Downing at Delegates and Individuals to the school board on 9/5/2024. The suggestion was ignored.

What’s Happening?

In the Timberlane Regional School District (TRSD), consisting of Atkinson, Danville, Plaistow, and Sandown, there is an ongoing battle over the district’s budget.

Why?

- The Timberlane Regional School Board has two responsibilities: (1) to provide quality education services to the district and (2) to do so in a fiscally responsible manner.

- Depending on which town you live in, the TRSD budget makes up somewhere between 60-80% of a property owner’s annual tax bill.

- The Timberlane Regional Budget Committee builds the proposed budget starting in September of each year. This budget needs to be built responsibly.

What can be done?

Join the Facebook group to stay up to date on the latest discussions.

The Timberlane Regional School Board is responsible for how the funds allocated in the budget are spent (or not spent). Budgeted monies not spent at the end of the fiscal year are referred to as the “unassigned fund balance” or “surplus” – this should be RETURNED to the taxpayers!

Short term:

- Contact your town’s Budget Committee members and ask them to reduce the upcoming year’s proposed budget.

- Contact your town’s School Board members and ask them to stop spending dollars in the unassigned fund balance and instead return those dollars to the taxpayers.

- Attend School Board meetings and Budget Committee meetings. Familiarize yourself with the various other committees and attend those meetings as well – they all have the potential to impact how your tax dollars are spent. See the committees listed on the left side of the School Board site.

Mid-term:

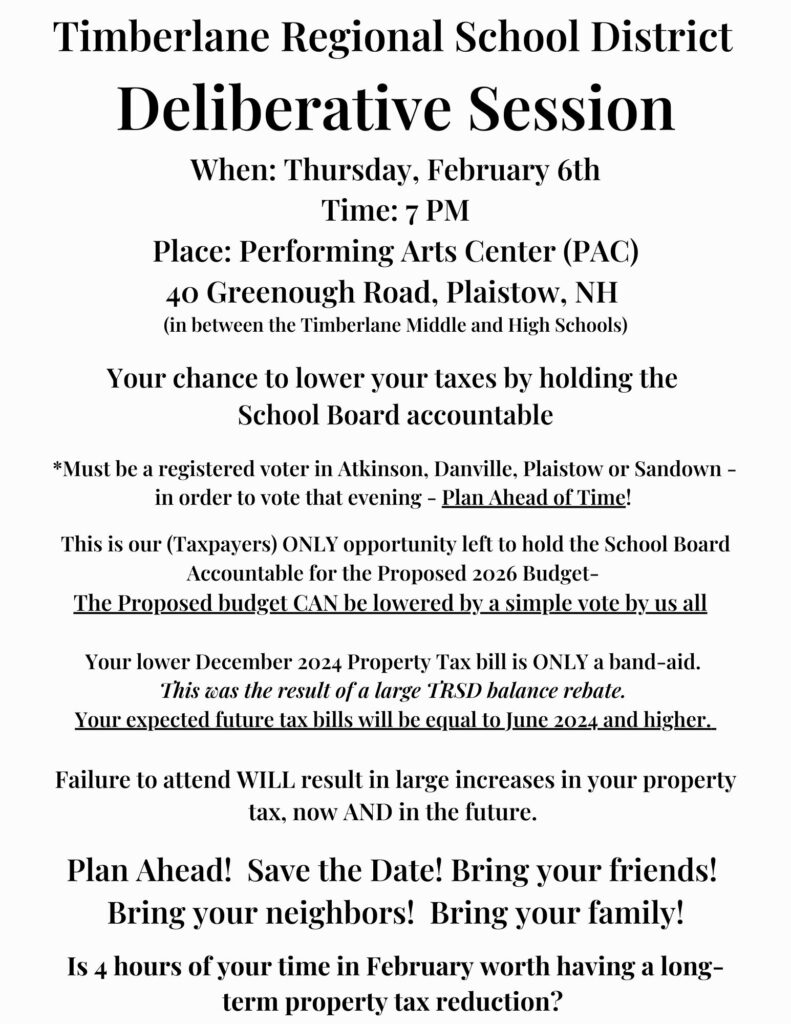

- Attend the Timberlane Deliberative Session in February. This is the opportunity for constituents to suggest and vote on amendments to the proposed budget before it goes to the ballot in March.

Long term:

- Run for school board or school budget community in your town, or identify people in your community who are interested in running. Get out on election day, vote for RESPONSIBLE candidates, and tell everyone you know to do the same.